CO-INVESTMENT TIES: WHERE THE LINES CONNECT FOR BOTH SAUDI AND INTERNATIONAL VCS

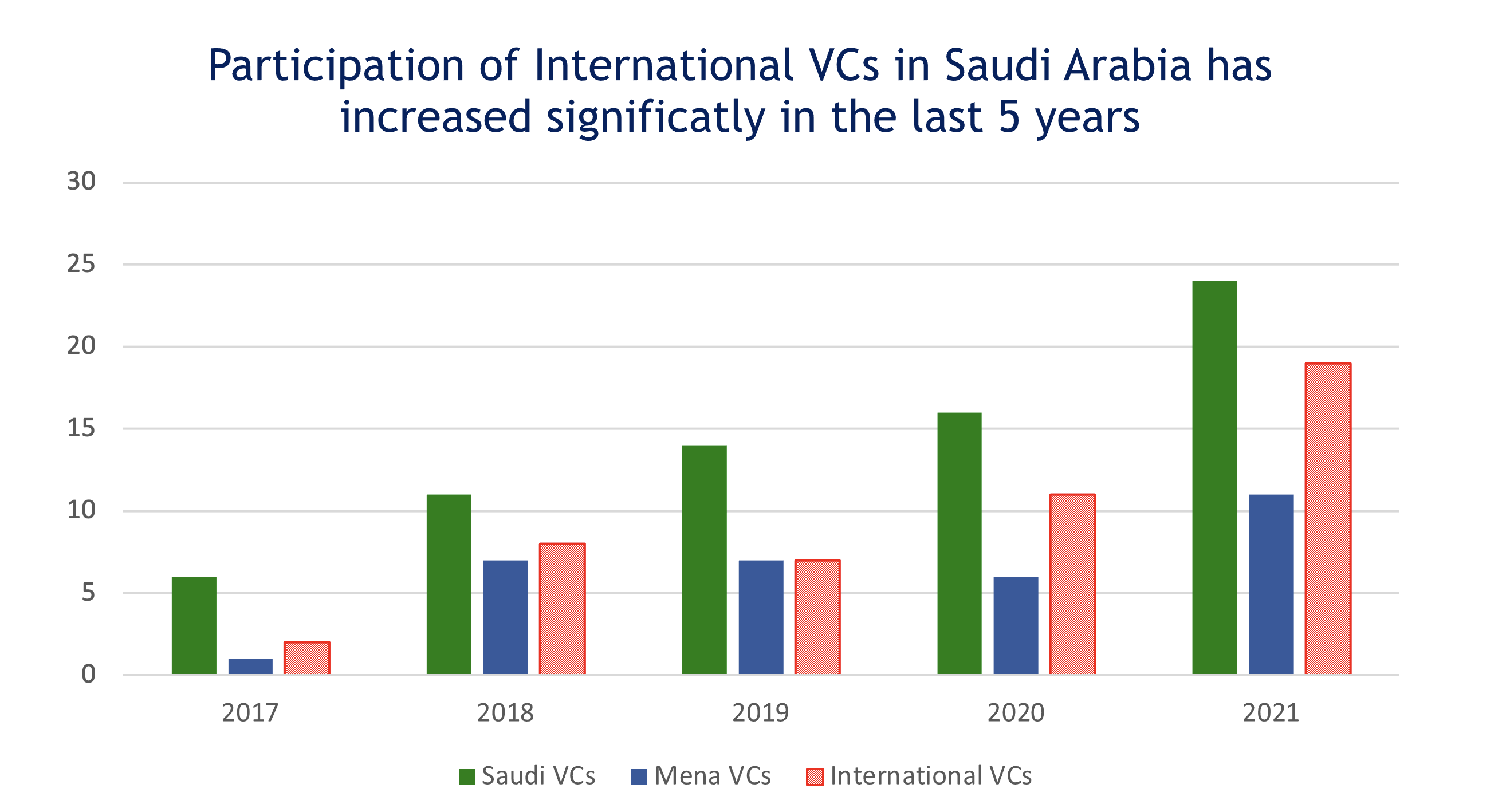

The MENA region's fast-growing startup landscape, and the appetite for co-investing, has attracted significant interest from international investors during the past few years, contributing to an increasingly oversubscribed Saudi market. Top global investors are starting to co-lead the country's largest VC deals, with some of Silicon Valley's most respected VCs looking to participate.

The most notable global VC penetration in Saudi Arabia has been by Californian-based Sequoia Capital, which accounted for 45 percent of all capital deployed into the country's funding rounds so far. The VC firm's investment in fintech startups FOODICS ($170 million Series C) and Lean Technologies ($33 million Series A) was almost seen as a breakthrough for the relatively young Saudi ecosystem.

This trend of 'syndicate' cross-border investments might leave some local VC firms worried about their own ability to compete with open-checkbook investors ready to pour millions of dollars into the current small, oversubscribed, circle of high-growth Saudi startups. Reality however tells us that this fear is misguided, and the opportunity to co-invest alongside VC giants like Tiger Global, Sequoia, or even Softbank, is closer to a lottery ticket for most emerging ecosystems than it is a losing bet.

According to research, the relationship that results between domestic investors and international firms as they co-invest is a complementary one, not just for those parties involved, but for the entire ecosystem. On the one hand, local VCs provide the geographic closeness, cultural knowledge, and institutional accessibility that foreign VCs have historically lacked, which makes them perfect hooks for these global VCs to latch onto as they enter the region.

On the other hand, foreign VCs have a long history of supporting emerging market startups in terms of scale, globalization, and exit strategies that ultimately makes their entrance a tactic to authenticate and an opportunity to level up the local investment space for domestic VCs to then support.

The Wave is here to Stay

In the first quarter of this year, 50 percent of the ten largest funding rounds in Saudi-based startups were co-investment deals led by both regional and international investors. Nana, the Saudi-based grocery delivery app, which raised the highest VC capital during the period, attracted funds from leading local firms like STV and Impact46, as well as the US-based Quencia Capital for its $50 million funding round.

Other Saudi startups in the top ten list also received foreign capital: Lean technologies' $33 million Series A was supported by Sequoia Capital and Liberty City ventures, Retailo's $29 million round included Graphene Ventures and Mentors Fund, and Penny Software’s $5 million Seed round joined both Hambro Perks (Oryx Fund) and Class 5 as global co-investors.

When compared to cross-border investments made in the Kingdom during the past three years, the trend experienced during the first quarter presents an overwhelmingly high percentage which cannot be overlooked - and the increase is only expected to grow.

Analyses of cross-border investments in emerging markets show that once international firms start investing, particularly in early-stage startups, they tend to continue investing in that market for quite some time. This gives a clear indication that the co-investment trend currently taking shape across Saudi is probably here to stay.

Source: Saudi Aramco Entrepreneurship Centre (Wa'ed), 2022.

International firms, particularly those who are entering the market for the first time, are also more likely to form 'syndication alliances' with local partners. Instead of leading funding rounds on their own, global VCs set clear aims to co-invest alongside domestic VCs, and historical data, though relatively outdated, supports this preference. In fact, individually led cross-border venture investments made between 1971 and 2009 largely underperformed in comparison to investments made by domestic VCs. This, according to the study published by White Rose Research Online, is because of the "geographic distances, cultural disparities, and institutional differences" that complicate foreign VCs' interaction with the new market.

To a large degree, forming syndicate ties can be sound investment opportunities for global firms, as it can be for local VCs.

Two Firms, One Focus

The general nature of Saudi venture firms being young and newly formed, they largely share the common challenges associated with emerging markets, driven by a limited deal flow and lack access to global, 'extra-industry, networks which would support their growth and the growth of their portfolio startups. These two challenges, especially concerning global ties, have a direct influence over a successful exit orchestrated by a young VC. In fact, the effects of the shortages that strain young VCs are mostly felt by the local startups themselves.

Fortunately, collaborating with global VCs and optimizing the exposure generated from closing co-investment rounds provides a powerful solution to address those challenges. Global firms can act as an international network bridge for the co-funded startups, boosting their industry awareness, benchmarking capabilities, and globalization options. The earlier they are invited to the table, the more exponential their advantages can become.

When foreign VCs get involved with startups early on, their experience enables them to set up better due diligence and contractual terms, and their early exposure to the founding team and minimal viable products (MVPs) increases their ability to help refine their managerial styles as well as their product-market fit. This value-add support shortens the learning curve for startups in emerging markets who will then find it easier to scale and globalize - and if they have been backed by both domestic and international VCs, they'll even reach a higher tendency to lead more successful exits and potentially record higher post-IPO performances. This indirectly unlocks the potential that sits within the Saudi ecosystem and maximizes its impact for domestic VCs to properly navigate.

With more early-stage tech startups receiving the needed push to globalize, the one-sidedness of the MENA startup economy will gradually start to fade. A more dynamic and globally reciprocal flow between the region's VC firms and those operating internationally yields a better economic environment for the three parties involved, domestic VCs, global VCs, and local startups, as the studies on emerging markets in Asia, Latin America, and the Middle East shows.

Afterall, aiming to form successful syndicate alliances not only requires local and regional VCs to advance their own investment proficiency and understanding of their domestic markets, it also requires them to align their investment strategies when it comes to industry focus - a criteria closely relevant to the likelihood of co-investment success. Despite its current success, drawing international interest has not been an easy task, but the stronger local VCs prove to be, the higher the likelihood of attracting global players.

What this means for the Saudi ecosystem is a call for action to look beyond Fintech, E-commerce, and logistics, which are currently popular sectors in the region. Saudi VCs should focus more on sectors like Healthtech, Cleantech, Edtech, or even gaming and virtual reality (VR) technologies, all of which are hugely popularized in Europe, the US, and Asia for example.

Between January and April, over $451 million was recorded in venture capital deals in the Kingdom according to reports from MAGNiTT and Wamda. This is the highest it has ever been for a four months period, and Sequoia Capital's co-investments accounted for $203 million of that total.